Federal Reserve Chairman Ben Bernanke is printing money again, and outraged critics at home and abroad are predicting that this aggressive plan will boost inflation, weaken the dollar and “monetize the debt,” something Bernanke told congress under oath he would not do.

Bernanke has admitted that this is new territory. There could be unintended consequences even if the plan works. The hope is that the additional cash banks find themselves with will be used to extend credit to businesses and consumers. But savvy consumers are realizing that getting out of debt is the best way to protect their future. With interest rates at all-time lows, those who aren’t borrowing now won’t be enticed to borrow when interest rates rise.

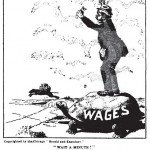

Inflation experts are predicting massive price increases in the near future. Companies say material costs are rising fast and threaten to pressure profits. Soon, these pressures could translate into inflation at the consumer level. With the Federal Reserve rolling out this second phase of quantitative easing by printing $600 billion of new currency the results for consumers could be catastrophic.

The billionaire, George Soros, has also called for the controlled devaluation of the dollar. Soros was responsible for the collapse of the Bank of England as well as several foreign currencies, and views the United States as the “main obstacle” to a new world order.